Bank Reconciliation Statement:

This Problem will help you to understand that how we prepare bank reconciliation statement,

how we reconcile our cash book and pass book balance, and point out error.

BRS Practical Example:

The bank statement of usman brothers indicates as balance of Rs.4000 on January 30 2014, .the balance of a cash in bank account of usman brothers’s ledger on that date is Rs.2850 the following cause of disagreement are traced:

- The deposit made on 31 January, were not recorded in bank statement Rs.300.

- Outstanding cheques are Rs.960.

- Bank collected Rs.500 from notes receivable

- The bank credited the amount of cheque deposited Rs. 420 the original amount of cheque war Rs.440.

- Collection charges on notes receivable Rs.20.

- A cheque for Rs.680 issued in favour of of owner ha been recorded as Rs.640 by the bank.

- A cheque for v480 deposited into bank was recorded as 440 in cash receipt journal.

- A cheque of Rs.750 issued for stationery purchased was recorded as Rs.700 in cash payment journal.

Also read there post to understand well:

- What is Bank Reconciliation Statement

- Why we Prepared Bank Reconciliation Statement

- Debit and Credit Rules

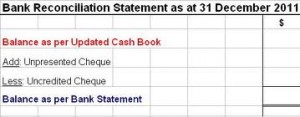

Usman Brothers

Bank Reconciliation Statement

As on January 30, 2014

| (A)Balance as per cash Account (Dr.)Add: Note collected by the bank Error in recording (480-440)Less: Service charges Rs.20 Depositor’s Error (750-700) 50 |

Rs.2850 +500 +40 3390 (70) |

|

Adjusted Balance (Dr.) |

3320 |

| (B) Balance as per Bank Statement(Cr.)Add: Deposits in transitError committed by the bank (440-420) Less: Outstanding cheques Rs.960Bank error (680-640) 40 |

4000 +300 +20 4320

(1000) |

|

Adjusted balance(Cr.) |

3320 |

Hope the following example helps you to understand that how we prepare bank reconciliation statement.