Inflation is the process in which there is a continuous increase in the general price level and the money is continuously losing its value.

Everybody know the term inflation but majority did not understood it.

In simple word we can say that in inflation the power of Money is losing.

According to Gardner Ackley definition “Persistent and appreciable rise in general level or average of prices”.

What is Inflation ?

Inflation is an upward movement in the average level of prices. Its opposite is deflation, a downward movement in the average level of prices. The boundary between inflation and deflation is price stability.

Inflation is the continued upward movement in the general level of prices.

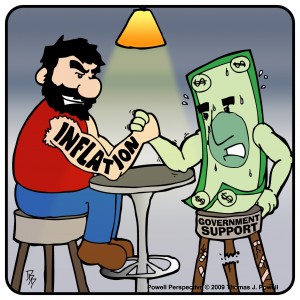

Here i am posting a funny picture which show you that how money becomes devalue in Inflation season.

Causes of Inflation

Inflation means there is a continued increase in the price level. The main causes of inflation are both excess aggregate demand (economic growth too fast) or cost push factors (supply side factors)

1.Demand pull inflation

If the economy is at or close to full employment then an increase in the price level. As firms reach full volume, they respond by putting up prices, leading to inflation. Also, near full employment, workers can get higher wages which increases their spending power.

2. Cost Push Inflation

If there is an increase in the costs of firms, then firms will pass this on to consumers.Cost push inflation can be caused by many factors.

You may also like to Read:

Prices of Raw Material :

The best example is the price of oil, if the oil price increase by 20% then this will have a significant impact on most goods in the economy and this will lead to cost push inflation. E.g. in early 2008, there was a spike in the price of oil to over $150 causing a temporary rise in inflation.

Import prices:

One third of all goods are imported in the UK. If there is a devaluation then import prices will become more expensive leading to an increase in inflation. A devaluation / depreciation means the Pound is worth less, therefore we have to pay more to buy the same imported goods

Rising wages:

If trades unions can present a common front then they can bargain for higher wages. Rising wages are a key cause of cost push inflation because wages are the most significant cost for many firms. (Higher wages may also contribute to rising demand)

Declining Productivity

If firms become less productive and allow costs to rise, this invariably leads to higher prices.

Profit Push:

When firms push up prices to get higher rates of inflation. This is more likely to occur during strong economic growth.

Higher taxes

If the government put up taxes, this will lead to higher prices, However, these tax rises are likely to be one-off increases. There is even a measure of inflation (CPI-CT) which ignores the effect of temporary tax rises/decreases.

What else could cause ?

Increase in house prices:

Rising house prices do not directly cause inflation, but they can cause a positive wealth effect and encourage consumer led economic growth. This can indirectly cause demand pull inflation

Printing more money

If the Central Bank prints more money, you would supposed to see a rise in inflation. This is because the money supply plays an important role in determining prices. If there is more money chasing the same amount of goods, then prices will rise. Hyperinflation is usually caused by a risky increase in the money supply

However, in special circumstances – such as liquidity trap / recession, it is possible to increase the money supply without causing inflation. This is because in recession, an increase in the money supply may just be saved, e.g. banks don’t increase lending but just keep more bank reserves.