Advantages and Disadvantages of Sole Proprietorship

Thinking of starting your own business? One of the simplest ways to hit the ground running is by choosing a sole proprietorship — the most common small business structure across Pakistan and worldwide. It’s straightforward, cost-effective, and ideal for those who want full control over their venture without the red tape of forming a company or partnership.

A sole proprietorship is a single-owner business where the individual and the business are legally the same entity. That means you’re the boss — you make the decisions, keep the profits, and take on the responsibilities. It’s a popular choice for freelancers, small shop owners, online sellers, consultants, and anyone looking to launch a business with minimal paperwork and maximum flexibility.

What makes it so attractive? It’s easy to set up, requires little capital, and has fewer regulatory hurdles compared to corporations or LLCs. Whether you’re launching a small retail shop, a home-based consultancy, or your first e-commerce store, a sole proprietorship offers a quick and accessible path to becoming your own boss.

In this guide, we’ll break down the key advantages of a sole proprietorship, how it compares to other business ownership structures, and what you need to consider before taking the plunge. So, if you’re ready to take control of your future, keep reading — this could be the best business decision you make.

What Is a Sole Proprietorship?

A sole proprietorship is the most basic form of business ownership — and also the easiest to understand. In this structure, there’s no legal separation between the individual owner and the business. That means you, the sole proprietor, are personally responsible for all aspects of the business — the profits, the decisions, and yes, even the debts.

Legally, a sole proprietorship isn’t considered a separate entity. You don’t need to register a company with complex documents or pay formation fees. In most cases, your business is simply an extension of you — which is why it’s the go-to option for freelancers, online entrepreneurs, shopkeepers, and consultants.

One of the key features of a sole proprietorship is flow-through taxation. This means that the income generated by the business “flows through” to your personal tax return. You’re taxed only once — at your individual income tax rate — instead of facing double taxation like corporations do. It’s a straightforward and often cost-saving approach to managing small business finances.

However, it’s important to note that with simplicity comes risk. Since there’s no legal separation between you and your business, you face unlimited legal liability. If your business incurs debt or faces a lawsuit, your personal assets — like your savings, car, or even home — could be at stake.

In short, a sole proprietorship offers full control and easy setup, but also places full responsibility on your shoulders. It’s perfect for entrepreneurs who are just starting out and want a low-barrier way to test and grow their business idea.

1. Full Management Control

One of the biggest advantages of a sole proprietorship is the total management control it gives you. As a single-owner business, you have the freedom to make decisions instantly—without needing to consult partners, shareholders, or a board of directors.

Want to change your pricing strategy? Launch a new product? Pivot your services? You can do all of that and more, without delays or red tape. This level of autonomy and flexibility is especially valuable in fast-paced industries or when running a small business that needs to adapt quickly to market trends.

Being the sole decision-maker also means your business can stay true to your vision. Whether it’s your brand identity, customer service style, or growth strategy, every move reflects your personal approach and goals.

This streamlined decision-making process often leads to quicker innovation, stronger customer relationships, and a more agile business model — giving sole proprietors a competitive edge in today’s fast-moving economy.

If you’re someone who values independence and wants full authority over how your business operates, this is where a sole proprietorship truly shines.

You may also like to Read:

2. Simple and Low-Cost Setup

If you’re looking for a hassle-free way to start your business, a sole proprietorship offers the easiest and most affordable path. In many regions, there’s no formal registration required, which means you can get started without the lengthy documentation or legal complexity associated with forming a corporation or partnership.

The ease of starting a sole proprietorship is one of its biggest draws for new entrepreneurs. In most cases, all you need is a trade name (if you’re not using your own name), a local business license, and you’re good to go. No need for expensive legal consultations or incorporation fees — making it a great option for small businesses on a tight startup budget.

You’ll also benefit from minimal regulatory requirements. There’s less paperwork, fewer compliance rules, and reduced ongoing maintenance compared to other business structures. This allows you to focus more on running your business rather than dealing with administrative burdens.

In short, the business setup cost is low, the process is quick, and the barriers to entry are minimal. Whether you’re a freelancer, an artisan, or someone starting a home-based business, this simplicity lets you test your ideas without major upfront investment or risk.

3. Tax Simplicity

One of the most appreciated perks of running a sole proprietorship is how simple the tax process can be. Unlike corporations that deal with complex filings and potential double taxation, sole proprietorship owners benefit from what’s known as flow-through taxation.

Here’s how it works: all the income your business earns flows directly to your personal tax return — typically filed on Schedule C along with your Form 1040. You don’t file a separate business tax return, and your business profits are taxed just once at your individual income rate.

This structure eliminates double taxation, where both the company and the owner are taxed separately — a common issue faced by corporations. Instead, the taxation for sole proprietorship owners is streamlined and transparent, making it easier to manage your finances and predict your tax liability.

Plus, you may be eligible for a variety of small business tax deductions — like home office expenses, business mileage, or startup costs — which can reduce your taxable income even further.

For small business owners who want to keep things simple, efficient, and cost-effective, this tax structure is a major advantage.

4. Privacy and Control Over Finances

As a sole proprietor, you enjoy a level of financial privacy and autonomy that other business structures often can’t offer. Since there’s no legal requirement to publish financial statements or disclose your earnings to the public, you maintain full discretion over how much your business earns — and how that income is used.

Unlike corporations, which may need to report profits, file separate tax returns, or answer to shareholders, a sole proprietorship keeps things simple and private. You’re not obligated to release your financial records to government bodies or investors beyond your personal tax obligations.

Even better, you have full control over profit distribution. You decide whether to reinvest earnings into the business, save them, or spend them however you choose. There’s no board of directors, no partners to consult — just you and your financial goals.

This level of business income flexibility is ideal for entrepreneurs who value independence and prefer not to have their financials scrutinized. Whether you’re reinvesting in inventory, saving for future expansion, or simply paying yourself a steady income, the choice is entirely yours.

For many small business owners, this kind of privacy and financial control is not just convenient — it’s empowering.

5. Direct Access to All Profits

One of the most rewarding sole proprietorship advantages is that all profits go directly into your pocket — no splitting, no waiting, and no shareholder approvals.

As the sole owner of your business, you have direct profit ownership, meaning every rupee your business earns (after expenses and taxes) is yours to keep. There’s no need to distribute income as dividends or allocate portions to business partners. Whether you’re running an online store, a consulting service, or a local shop, your earnings reflect your effort — and you have full control over how they’re used.

This kind of direct access to income gives you unmatched flexibility. Want to reinvest in equipment? Pay yourself more this month? Build up savings for growth? It’s entirely your decision. Unlike corporations where profits may be held or reinvested based on board decisions, a sole proprietorship allows for quick, personal financial decisions without delay.

For entrepreneurs who value ownership and want full financial control, this is one of the clearest benefits of choosing a sole proprietorship structure.

6. Ideal for Low-Risk Businesses or Freelancers

If you’re a freelancer, consultant, or running a service-based business with minimal physical risks, a sole proprietorship might be the perfect fit. For many low-risk business entities, this structure provides a cost-effective and straightforward way to operate legally without unnecessary complexity.

A freelancer sole proprietorship — such as a writer, graphic designer, digital marketer, or online coach — typically doesn’t face the same level of liability exposure as, say, a construction company or manufacturing unit. In these cases, the simplicity and flexibility of a sole proprietorship outweigh the need for advanced legal protections that come with forming an LLC or corporation.

You won’t need to worry about heavy compliance rules, shareholder meetings, or filing separate business tax returns. Instead, you can focus on growing your client base, improving your craft, and building a brand — without drowning in paperwork or incurring high setup costs.

For those in low-risk industries who want to test the waters of entrepreneurship or keep things lean and agile, the sole proprietorship offers the ideal balance between freedom and functionality.

Potential Disadvantages to Consider

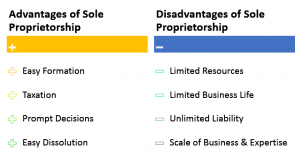

While a sole proprietorship offers plenty of advantages — like ease of setup, full control, and simple taxation — it’s important to understand the potential downsides before making your decision.

The biggest concern is unlimited legal liability. Since there’s no legal distinction between you and your business, you’re personally responsible for all debts, losses, and legal claims. This means that if your business is sued or falls into debt, your personal assets — including your car, savings, or even your home — could be at risk.

Another key challenge is capital raising constraints. Sole proprietors often face limited options when it comes to funding. You can’t issue shares or attract investors the way a corporation can, and banks may be hesitant to lend to unregistered or unincorporated businesses. This can slow down growth if you need capital for expansion, equipment, or inventory.

These disadvantages of sole proprietorship don’t mean it’s the wrong choice — but they’re worth considering, especially if your business is growing quickly or involves higher financial risk.

Want to learn how to protect your personal assets or explore funding alternatives? Check out our full guide on Sole Proprietorship vs. LLC – Which One Is Right for You?

⚖️ Sole Proprietorship vs. LLC: Which Is Better for You?

If you’re serious about starting a business, one of the biggest decisions you’ll face is choosing the right ownership structure. The two most popular choices among small business owners are a sole proprietorship and a Limited Liability Company (LLC). Both offer unique benefits, but they also come with key differences in liability protection, taxation, and legal complexity.

In a sole proprietorship, the business and the owner are legally the same. You get full control, simple tax filing, and minimal setup costs. But with those benefits comes unlimited liability, meaning you’re personally responsible for all business debts or legal claims.

On the other hand, an LLC creates a separate legal entity. It offers limited liability protection, shielding your personal assets if your business runs into financial or legal trouble. While LLCs require more paperwork and registration fees, they provide more flexibility in taxation and better credibility with investors and lenders.

To help you decide, here’s a side-by-side comparison:

Sole Proprietorship vs LLC – Quick Comparison Table

| Feature | Sole Proprietorship | LLC (Limited Liability Company) |

|---|---|---|

| Legal Entity | Not separate from owner | Separate legal entity |

| Liability Protection | ❌ Personal assets at risk | ✅ Limited personal liability |

| Taxation | Pass-through (Schedule C) | Pass-through or corporate tax option |

| Setup & Registration | Minimal or none | Requires formal registration |

| Cost to Start | Low | Moderate to high (varies by state) |

| Ownership Structure | Single owner | Single or multiple members |

| Credibility & Funding | Less formal; limited funding options | More formal; easier to get funding |

| Compliance Requirements | Very low | Annual reports, fees may apply |

Bottom Line:

If you’re just starting out, testing a business idea, or working in a low-risk environment, a sole proprietorship may be all you need. But if you’re growing rapidly, managing higher liability risks, or want to build long-term credibility, an LLC could be the smarter structure.

Still unsure which option is right for you? Check out our full guide: How to Choose Between Sole Proprietorship and LLC

Legal and Tax Considerations

While a sole proprietorship is the simplest business structure legally, there are still a few important details you need to know to stay compliant and maximize your financial benefits — especially when it comes to taxes and business registration.

Disadvantages of Sole Proprietorship:

Disadvantage of sole proprietorship are as follows:

Limited Capital: The capital of one proprietor is usually small. It is limited to his personal savings and borrowing on personal security. Hence, he cannot undertake further expansion and development lack of excess capital and fails to enjoy the internal and external economics of scale.

Limited Management Ability: In the present competitive world complexities of managerial jobs are increasing every day. One man cannot be expert in each and every function of the business. For lack of resources he may not be able to use the services of experts. So limited managerial ability will hinder the growth of the firm.

Do You Need an EIN as a Sole Proprietor?

An EIN (Employer Identification Number) is like a social security number for your business. While many sole proprietors can operate using just their personal identification number, there are cases where obtaining an EIN becomes necessary.

Here are the key EIN requirements for sole proprietors:

-

You plan to hire employees

-

You want to open a business bank account under your business name

-

You’re required to file excise taxes

-

You’re forming a retirement plan like a solo 401(k)

-

You prefer to keep your personal SSN private

Even if it’s not legally required, getting an EIN can make your business appear more professional and help streamline your financial operations. It’s free and easy to get from the IRS, even if you’re operating from Pakistan or running an online business targeting U.S. customers.

What Tax Deductions Can Sole Proprietors Claim?

As a sole proprietor, you may qualify for a variety of business-related deductions that can significantly reduce your taxable income. These fall under common small business tax strategies and are often overlooked by first-time entrepreneurs.

Popular tax deductions for sole proprietors include:

-

Home Office Deduction: If you work from home, a portion of your rent, utilities, and internet bills may be deductible.

-

Business Vehicle Use: You can deduct mileage or actual vehicle expenses related to business travel.

-

Office Supplies and Equipment: Laptops, printers, furniture, and even software tools you use to run your business.

-

Marketing and Advertising Costs: Website hosting, digital ads, graphic design, and branding services.

-

Professional Services: Legal or accounting fees tied to business operations.

-

Education and Training: Courses or certifications that enhance your business skills.

Properly tracking and claiming these deductions can help you save thousands annually. It’s smart to work with an accountant or use software that helps you stay compliant while taking full advantage of your eligible write-offs.

Tip: Keeping accurate records of all business-related expenses throughout the year makes tax season far less stressful — and much more profitable.

disadvantages of sole proprietorship

When to Switch from Sole Proprietorship to LLC or Corporation

Running a sole proprietorship is often the easiest way to start a business — but it’s not always the best long-term structure. As your business grows, you may face new challenges that call for stronger legal protection, better funding access, or a more formalized business identity.

So when should you convert your sole proprietorship to an LLC or corporation?

1. You’re Taking On More Risk

If your business starts interacting with more clients, hiring employees, or handling sensitive data, the personal liability risk increases.

LLCs and corporations offer a legal shield that protects your personal assets (like your house or savings) from lawsuits or business debts — something a sole proprietorship cannot provide.

2. You Want to Raise Capital

Investors and banks typically prefer formal business structures. If you’re planning to pitch to investors, apply for small business loans, or even bring on partners, switching to an LLC or corporation gives your business more credibility and legal structure.

This shift also opens doors to better funding options and strategic partnerships.

3. You’re Earning Significant Profits

As revenue increases, you may hit a point where it becomes more tax-efficient to operate under an LLC (especially if taxed as an S-Corp) or corporation.

You can potentially reduce self-employment taxes and structure your income more efficiently with payroll and dividends.

4. You Want a Distinct Business Identity

A sole proprietorship operates under your legal name by default. If you want to create a separate business name, build brand equity, or register a trademark, transitioning to a more formal structure helps you protect your brand and intellectual property.

When It’s Time, Make the Switch Smoothly

Converting a sole proprietorship to an LLC is a common and straightforward process in most states. You’ll need to file Articles of Organization, update licenses and bank accounts, and notify the IRS of your new structure.

Internal Link Tip: Consider linking to a detailed guide on “How to Convert a Sole Proprietorship to an LLC” if you’re offering one on your site.

⚠️ Hidden Costs & Risks Often Overlooked

While the simplicity of a sole proprietorship is attractive, many first-time business owners overlook critical risks that could have serious financial consequences. Here are two key areas where hidden costs can arise:

Bankruptcy Can Impact Personal Assets

In a sole proprietorship, there’s no legal separation between you and your business. That means if your business goes bankrupt or is sued, your personal assets — including your home, vehicle, or savings — could be on the line.

There’s no corporate shield to limit liability, so personal liability risk is one of the biggest downsides of this structure.

Insurance Is Not Optional

Because you bear full legal responsibility, business insurance is often a necessity, not a luxury. Depending on your industry, you may need:

-

General liability insurance

-

Professional liability insurance

-

Business property insurance

These costs add up and are frequently underestimated by new sole proprietors. It’s crucial to understand your sole proprietorship insurance requirements to protect your business — and your personal finances.

Pro Tip: Always consult a business attorney or CPA to evaluate whether your business type and risk profile justify staying a sole proprietor or transitioning to a limited liability structure.

❓ Common FAQs About Sole Proprietorships

Many new entrepreneurs have questions when starting out as a sole proprietor. Below are the most frequently asked queries — along with clear, concise answers to guide your next steps.

Can a Sole Proprietor Have Employees?

✅ Yes, a sole proprietor can hire employees, but you’ll need to obtain an Employer Identification Number (EIN) from the IRS to do so. Once you hire staff, you’re responsible for withholding and paying employment taxes, just like any other business structure.

Do I Need to Register My Sole Proprietorship?

It depends on your location. In many countries or states, a sole proprietorship doesn’t require formal registration — but you may still need to:

-

Register a business name (DBA) if different from your personal name

-

Get a local business license or tax registration

Even if registration is simple, be sure to comply with all business registration requirements in your city or province.

Can I Open a Business Bank Account as a Sole Proprietor?

Absolutely. Many banks allow sole proprietors to open a business bank account using your Social Security Number or EIN (if you have one).

Having a separate account helps keep your business income and expenses organized, and it also projects professionalism to clients and vendors.

Need help choosing the right business structure? Don’t forget to check out our guide on Sole Proprietorship vs. LLC to find out which fits your long-term goals better.

Final Thoughts: Is a Sole Proprietorship Right for You?

A sole proprietorship is one of the simplest and most accessible ways to start a business. Its advantages—like full control, minimal setup cost, pass-through taxation, and direct access to profits—make it ideal for freelancers, consultants, and low-risk ventures.

However, don’t overlook the risks. Unlimited personal liability, challenges in raising capital, and limited scalability can become roadblocks as your business grows.

If you’re unsure, it’s always wise to consult a small business attorney or tax advisor. They can help you evaluate whether a sole proprietorship is the right legal entity for your goals—or if it’s time to transition to an LLC or corporation for added protection and flexibility.

Remember: The best structure for your business balances simplicity with long-term growth and risk management.

Health Insurance Options for Sole Proprietors

Sole proprietors often don’t have access to employer-sponsored health plans. But options still exist:

-

Marketplace Plans: Through Healthcare.gov or state exchanges. Premiums may be deductible as a business expense.

-

Professional Associations: Some trade groups offer group insurance rates.

-

Health Savings Accounts (HSAs): If enrolled in a high-deductible health plan (HDHP), you can contribute pre-tax funds.

Best States to Start a Sole Proprietorship in the U.S.

While starting a sole proprietorship is simple in any state, some offer more business-friendly climates:

-

Wyoming: No income tax, low regulatory burden

-

Texas: No personal income tax and strong economy

-

Florida: Favorable tax climate, booming small business scene

-

Delaware: Business-friendly legal system

How Sole Proprietorship Affects Personal Credit Score

Unlike LLCs or corporations, sole proprietors are personally liable. This means:

-

Business debts can impact your personal credit score

-

Late payments, high credit usage, or defaults are reported to consumer credit bureaus

-

Using a separate business credit card or account helps isolate financial activity

Grants & Funding Opportunities for Sole Proprietors

Even without formal incorporation, sole proprietors can access funding through:

-

Small Business Administration (SBA) microloans

-

Local development agencies and state-specific grants

-

Business competitions and pitch events for startups

-

Private grant databases like Hello Alice, IFundWomen, or Grants.gov