How to make Ledger Account

Objective of Ledger:

The following objective of ledger are:

1.To classify the business transactions with a view to determine the real increase or decrease

in any item during a particular period.

2.To extract a Trial Balance for proving the arithmetical accuracy of the accounting record.

3.To provide a record of all the business transaction relating to a particular item, as to examine it easily in case need.

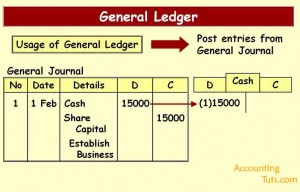

The practical example shows to you that how we post journal entries to ledger accounts and how we prepare ledger accounts.

You may also like to Read:

How to make ledger Account:

The following steps you need to follow to make ledger account;

When you passed the journal entries in General journal than it must transferred into Ledger Accounts,

it is called “posting of journal entries“.

The debit and credit values of journal entries are transferred to ledger accounts one by one in such a way that debit amount of a journal entry is transferred to the debit side of the relevant ledger account and the credit amount is transferred to the credit side of the relevant ledger account. After posting all the journal entries, the balance of each account is calculated. The balance of an asset, expense, contra-liability and contra-equity account is calculated by subtracting the sum of its credit side from the sum of its debit side. The balance of a liability, equity and contra-asset account is calculated the opposite way i.e. by subtracting the sum of its debit side from the sum of its credit side.

The ledger accounts shown below are derived from the journal entries of Company Haseeb & Co.

Asset Accounts:

| Cash |

Accounts Receivable | |||

| Rs.100,000 | Rs.36,000 | Rs.21,200 | Rs.15,300 | |

| 28,500 | 60,000 | |||

| 32,900 | 17,600 | |||

| 15,300 | 19,100 | |||

| 4,000 | 19,100 | |||

| 5,000 | ||||

| 3,470 | ||||

| Rs.20,430 | Rs.5,900 | |||

| Office Supplies | Prepaid Rent | |||

| Rs.17,600 | Rs.36,000 | |||

| 5,200 | ||||

| Rs.22,800 | Rs.36,000 | |||

| Equipment | |

| Rs.80,000 | |

| Rs.80,000 | |

Liability Accounts:

| Accounts Payable | Notes Payable | |||

| Rs.17,600 | Rs.17,600 | Rs.20,000 | ||

| 5,200 | ||||

| Rs.5,200 | Rs.20,000 | |||

| Utilities Payable | Unearned Revenue | |||

| Rs.2,470 | Rs.4,000 | |||

| 1,494 | ||||

| Rs.3,964 | Rs.4,000 | |||

Equity Accounts

| Capital | |

| Rs.100,000 | |

| Rs.100,000 | |

Revenue, Dividend and Expense Accounts:

| Service Revenue | Dividend | |||

| Rs.28,500 | Rs.5,000 | |||

| 54,100 | ||||

| Rs.28,600 | Rs.5,000 | |||

| Wages Expense | Miscellaneous Expense | |||

| Rs.19,100 | Rs.3,470 | |||

| 19,100 | ||||

| Rs.38,200 | Rs.3,470 | |||

| Electricity Expense | Telephone Expense | |||

| Rs.2,470 | Rs.1,494 | |||

| Rs.2,470 | Rs.1,494 | |||

After the ledger accounts have been prepare the next step is to prepare Trial balance.