What is Social Accounting?

Social Accounting is a first and primary accounting. Similar to traditional accounting, it is a method of calculating a company’s performance. Only with social accounting, performance is used generally to include social and environment effects.

Definition of Social Accounting:

We can define social accounting as;

“Social accounting (also known as social accounting and auditing, social and environmental accounting, corporate social reporting, corporate social responsibility reporting, non-financial reporting or accounting) is the process of communicating the social and environmental effects of organizations’ economic actions to particular interest groups within society and to society at large”. Reference

Explain Social Accounting

Social Accounting is the process of communicating the social and environmental effects of organization’s economic actions to particular interest groups within society and to society at large.

History of Social Accounting

Social accounting as an approach began developing in the UK in the early 1970s .

The public interest Research Group established Social Audit Ltd.

You may also like to Read:

What is the Purpose of Social Accounting?

- Accountability

- Management Control

Scope of Social Accounting

- Formal accountability

- Self-reporting and third party audits

- Reporting areas

- Audience

Objective of Social Accounting

- Effective utilization of natural resources

- Help to employees

- Help to society

- Help to customers

- Help to investors

Benefits and Importance of Social Accounting:

- Social accounting will provide you with an ongoing record of how your organization or enterprise has developed and changed over time.

- You will get feedback on how things are going from the range of people involved in your organization or enterprise.

- You will be able to identify the areas where things are working well and not so well – and you can use this information to help continue what you are doing well and make improvements to change what’s not working so well.

- You will know how well you are achieving your aims and values. Doing and the sorts impact it is having- information you can grants, and for promoting what you do.

Disadvantages or Limitations of Social Accounting:

- Social Accounting can be quite labor intensive, especially the first time. If the organization has not done basic strategic planning in some time. It can be difficult to progress through the process rapidly.

- Although engaging in a social accounting process can be seen as a commitment to improvement social accounting is not explicitly recognized by funders and lenders.

- The social accounting process is not particularly useful for benchmarking.

Challenges of Social Accounting:

For small member based community organizations and enterprises, the biggest challenges are finding a way to regularly carry out social accounting with no staff, no time and no budget! It is, therefore, important the social accounting process is as simple as possible so that it does not impose too heavy a burden on members.

Social Accounting Techniques:

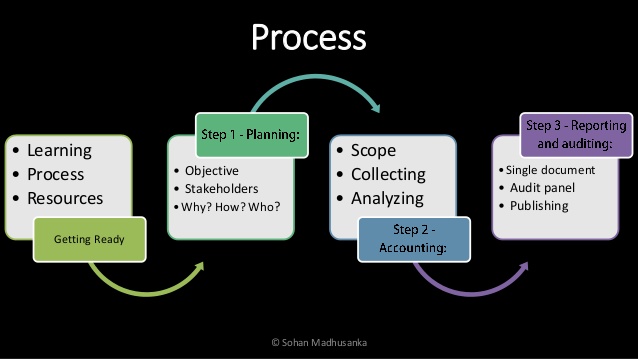

Social accounting Based on Three Steps

- Planning identification stage:

- The first step is to identify three key elements of your community organization or enterprise.

- Values, aims, and objectives

- Activities

- Accounting – deciding on the scope and setting up the social accounting System

- Design

- Collect information

- characteristics

- Reporting and auditing – collecting information

- Relevant information

- Results

Uses of Social Accounting

Need for Social Accounting

Every time the question arise that why the need for social accounting has arisen? the answer to this question is that the social Accounting justifies its social responsibilities and informs its members, the government, and the general public to enables everybody to form a correct judgment.

- It helps management in formulating suitable policies and programs.

- It acts as an evidence of social commitment.

- It improves employee motivation.

- It improves the image of the Organization.

- Through social accounting, the management gets a response on its policies pointed at the welfare of the society.

- It helps in marketing through better customer support.

- It improves the assurance of shareholders of the firm.