Commerce and Management Sciences World

Commerce, Financial Accounting, Human Resource Management,, Cost Accounting, Principles of Business

Accounting

10 Best Examples of Accounts Receivable

Steps to Collect Accounts Receivable

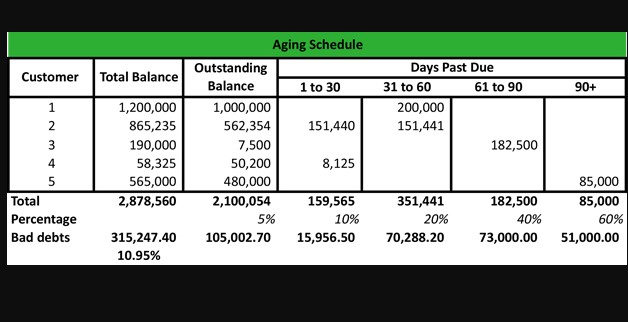

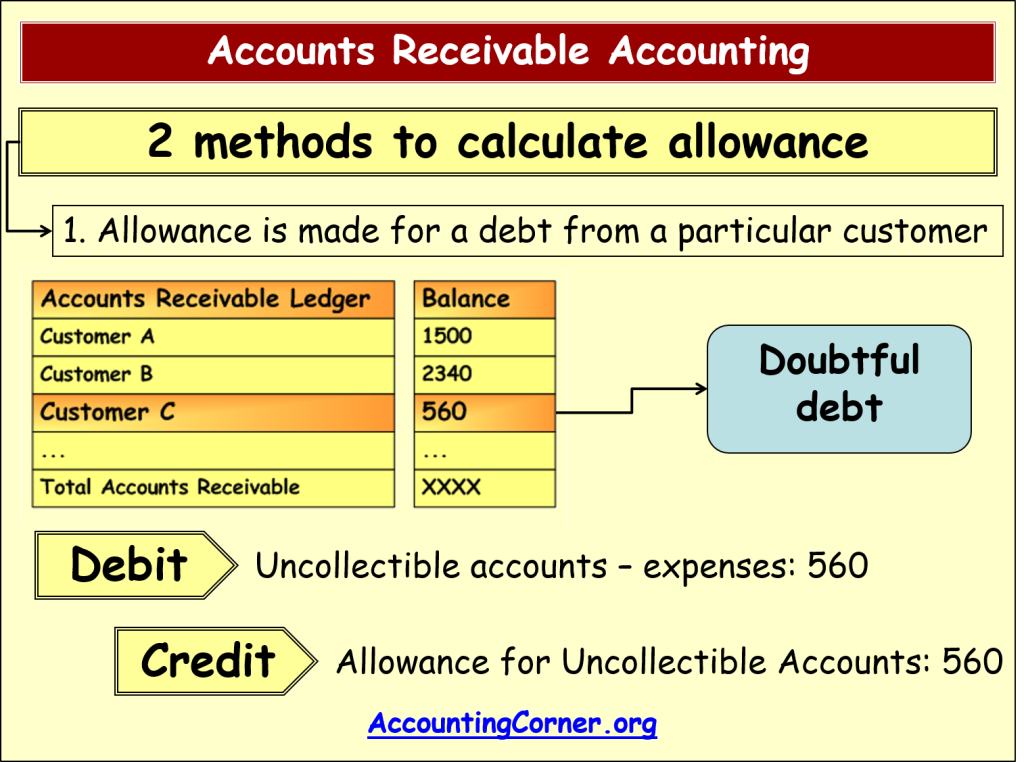

Allowance for Uncollectible Accounts Explained With Examples

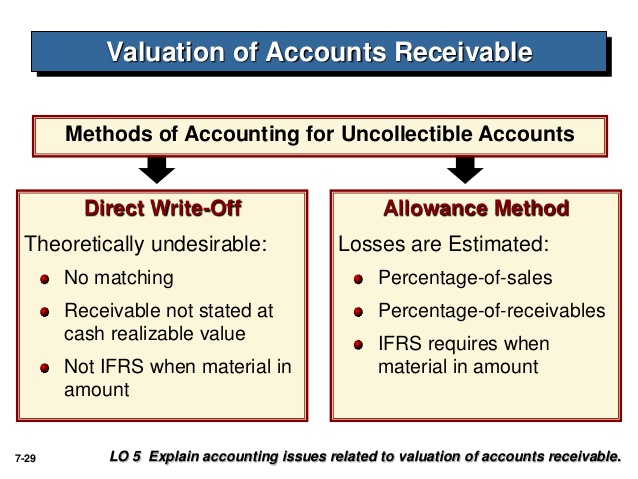

Direct Write-Off and Allowance Methods in Account Receivable

How to Evaluating Accounts Receivable Method

GST AND IMPORT/EXPORT

What is purchase discounts lost?

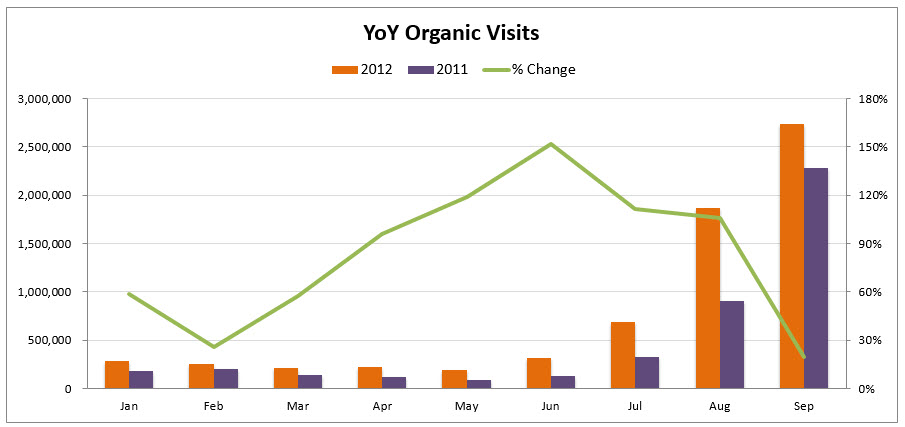

What is year over year (YOY)? Explained

Business Communication

What is Informal Communication: Meaning, Purpose and Importance

Difference between Formal and Informal Communication

What is Oral Communication: Meaning, Advantages and Limitations

Difference between Verbal (Oral) and Written Communication

What is Written Communication: Meaning, Advantages and Limitations

Auditing

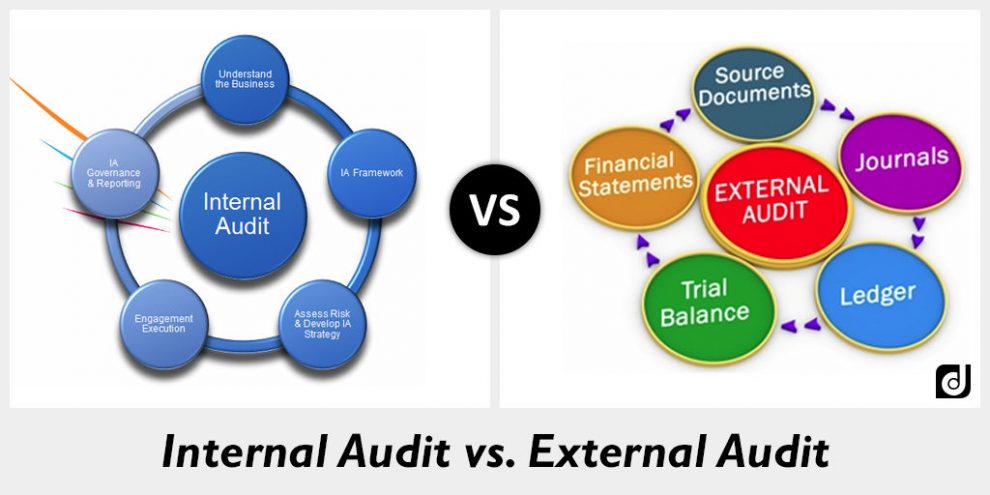

External vs Internal auditors | What is an auditor and why do I need one?

Liabilities of an Auditor Discuss in Details

What is Audit Working Papers

What is Audit Program | Definition Meaning Purpose Advantages

What is Audit Engagement Letter

Preparation Before Commencement of Audit

What are the 3 Types of Audits