This post will explain what a contra account is and how it works to correctly show the value of a organization’s financial statements. It will also provide examples to show the effect of contra entries.

What is Contra:

Contra means against. In Accounting terms, a contra account refers to an account which is balanced against an account.

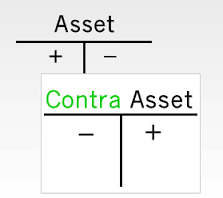

A contra account is a general ledger account which is planned to have its balance be the opposite of the normal balance for that account classification.

Definition of a Contra Account:

A Contra Account is where we record transactions that are opposing to a general ledger parent account, also called a relating account.

Contra accounts allow us to report the true value of a organization’s assets. The balance of the contra account will equalizer its parent account while still stabilizing the value of the transactions identified in the relating account.

What is a Contra Account?

Contra account is an account that appears as a subtraction from another account on balance sheet of a company. For example, provision for bad debts is a contra account of accounts receivable. Accounts receivable is the main account with a debit normal balance and provision for doubtful debts is an account with credit normal balance which offsets the main account.

In an accounting system, ledger accounts are designed to contain similar classes of transactions. But for presentation purposes it is sometimes necessary to show net balance of two accounts.

For example, there need to be separate accounts to hold the actual cost of property, plant and equipment and related accumulated depreciation. If we record depreciation related adjustments in the cost accounts we will lose key information about the original cost of the assets and accumulated depreciation. To avoid this loss of important data, we record actual cost and depreciation in separate ledger accounts.

However, it will be meaningless to show the property plant and equipment cost account and the related accumulated depreciation account separately on the balance sheet. We need to show the net book value of the property plant and equipment which equals the cost of PPE offset by related accumulated depreciation which is a contra account.

You May also Like to Read:

Why Contra Account Is Important?

Contra accounts are important because they let a company to track the matching principle by recording an expense initially in the contra asset account.

The contra asset account is later reduced when the expense is recorded. Business owners should understand the functions of contra accounts and their significance to keeping accurate financial records.

List of Contra Accounts:

Contra accounts can be categorized as following:

- Contra Equity Accounts

- Contra Asset Accounts

- Contra Revenue Accounts

- Contra Expense Accounts

Contra Account Examples:

Think about dividends. Dividends are money paid to shareholders (owners) of a company for their investment. Dividends are not recorded as an expense account, but instead are a contra capital account. Capital accounts track the sources of capital of the organization. Dividends are not a source of capital, but instead are a use of capital. Dividends is a debit account, capital accounts are normally credit accounts.

1 – You can have a contra asset account, contra liability account or a contra equity account.

2 – Contra accounts always have a normal balance that is the OPPOSITE.

- Assets = debit,

therefore - contra asset = credit.

- Liability = credit,

therefore - contra liability = debit.

3 – Think of contra accounts like friends that stick together. If it is accumulated amortization-equipment, it will always be under the equipment account on a financial statement (balance sheet/trial balance). They always Stick together like friends

4 – Contra accounts reduce the net balance of an account. For example, if we have a plant that has a cost of Rs.700,000 and there is a contra asset account of accumulated amortization-plant with a balance of Rs.100,000 the net realizable value will be Rs.600,000 for that asset.

Why Do We Have Contra Accounts?

Well we must record things like most assets at cost like a building. Which means we can’t just credit the building account when it depreciates. It must stay at cost! Therefore we need another way to bring its value/net balance down. That is the purpose of the contra account.

Contra Account Journal Entry:

Here is an example to explain what we have defined. If Adnan & Co sells Rs.500,000 of merchandise on credit, the accounting entry is a debit to Accounts Receivable for Rs.500,000 and a credit to Sales for Rs.500,000.

If customers return Rs.60, 000 of this merchandise, Adnan & Co will debit Sales Returns and Allowances (a contra revenue account) for Rs.60,000 and will credit Accounts Receivable for Rs.60,000. Adnan & Co’s income statement will report Gross Sales of Rs.500,000 less Sales Returns and Allowances of Rs.60,000 resulting in Net Sales of Rs.440,000.

Journal Entries

| Date | Particular | Dr. | Cr |

| Account Receivable

To Sales |

500,000 |

500,000 |

|

| Sales Returns & allowance

To Account Receivable |

60,000 |

60,000 |

Income Statement

| Sales | 500000 |

| Less: sales return & Allowance | 60000 |

| Net Sales | 440000 |

How and Why Contra Accounts Are Used

Consider the following story: visualize you are a Tax Consultant who has your own practice. Today, you provide tax consultancy to nine different clients. That story does not change even if you expect you will not be paid for two of those Clients. You still provide consultancy to seven clients, whether you were paid immediately or not.

The transactions are recognized and recorded in gross revenue and accounts receivable by the billing office, as the amount earned and not yet paid.

However, if the billing office stopped there, you would overemphasize your assets and net income. You must also report the amount that you can reasonably expect will not be paid, if it is admirable and possible. You could simply adjust the parent account…but then you are missing an essential part of the story , how many clients were actually given Tax consultancy today.

Important Note for Contra A/c:

Contra Accounts are permanent and do not close it at end of financial year.

you can close Amortization or Depreciation expense.

You can visit to learn more about what is contra account.