Days Sales Outstanding (DSO):

Days Sales Outstanding is also called the average collection period or days’ sales in receivables, measures the number of days it takes a company to collect cash from its credit sales.

Alternatively, it displays how well a company can collect cash from its customers. The quicker cash can be collected, the faster this cash can be used for other tasks.

It should be remembered that both cash flows and liquidity increase with a lower day’s sales outstanding measurement.

Days Sales Outstanding Definition:

Days’ sales outstanding ratio (also called average collection period or days’ sales in receivables) is used to measure the average number of days a business takes to collect its trade receivables after they have been created. It is an activity ratio and gives information about the efficiency of sales collection activities.

Keep reading I will tell you how you will next how Days sales outstanding calculate and its usage.

You may also read to like:

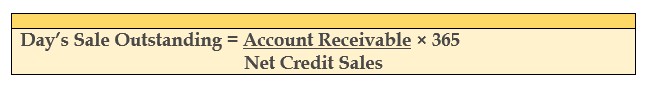

Formula Used to Calculate DSO:

The DSO ratio is calculated by dividing the ending accounts receivable by the total credit sales for the period and multiplying it by the number of days in the period. Frequently this DSO is calculated at the end of the year and multiplied by 365 days.

An example of Daily sales outstanding:

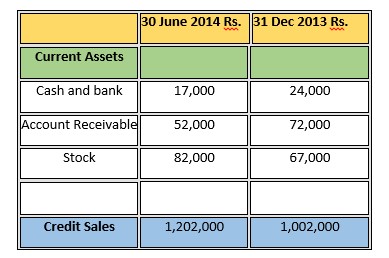

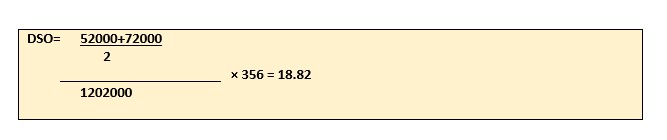

The data is taken from the financial statement of TOYO Co for the year ended 31 Dec 2014 are as follow:

Using the above illustration, we can determine that during the end of year 31 Dec 2014 it took TOYO an average of 18.82 days to collect revenue receipts from its trade debtors.

Scrutiny/ Analysis of Day Sales Outstanding:

The lower value of Days Sales Outstanding is favorable whereas a higher value is unfavorable. Though it is more expressive to create monthly or weekly trend of DSO. Any major increase in the trend is unfavorable and shows inefficiency in credit sales collection.

-

Problem With Days Sales Outstanding Example

-

Method to calculate days sales outstanding in excel

-

dso calculation template excel

If you want to learn more about Day’s Sale Outstanding you can visit.