Financial Ratio Analysis

Financial Ratios are mathematical assessments of financial statement accounts. Financial Ratio Analysis is performed by comparing two items in the financial statements. The resulting ratio can be interpreted in a way that is not possible when interpreting the items alone. In simple words, we are analyzing interrelationships.

The connections between the financial statement accounts assist shareholders, creditors, and internal company management to understand how well a business is performing and which parts of the business needing improvement.

Financial ratios are the most well-known and extensive tools. It is used to analyze a business’ financial standing.

Ratios are simple to calculate and easy to understand for top level management. Ratios can also be used to compare different companies in different industries. Subsequently, a ratio is just a mathematically comparison based on proportions, large and small companies can use ratios to compare their financial information.

Ratios let us compare companies across industries, to recognize their strengths and weaknesses.

The CEO/Proprietory of an organization don’t have enough time to read the lengthy numeric financial statements (profit loss & balance sheet) and it takes a lot of their time to understand and analyzed the whole financial statements so they always preferred Financial Ratio Analysis to keep an eye on their business’ financial position.

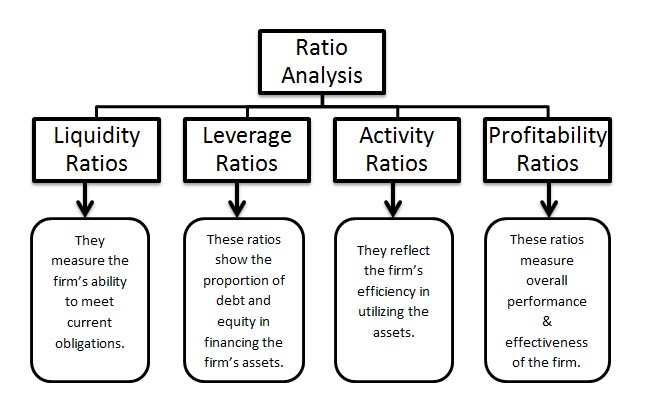

The Financial ratios can be categorized into seven main ratios that are:

- Liquidity Ratios

- Solvency Ratios

- Debt to Equity Ratio

- Equity Ratio

- Debt Ratio

- Efficiency Ratios

- Accounts Receivable Turnover

- Asset Turnover Ratio

- Total Asset Turnover Ratio

- Inventory Turnover

- Days’ sales in Inventory

- Profitability Ratios

- Gross Margin Ratio

- Profit Margin

- Return on Assets

- Return on Capital Employed

- Return on Equity

- Market Prospect Ratios

- Earnings Per Share

- Price Earnings Ratio or P/E Ratio

- Dividend Payout Ratio

- Dividend Yield

- Financial Leverage Ratios

- Debt Ratio

- Debt to Equity Ratio

- Equity Ratio

- Coverage Ratios

- Debt Ratio

- Debt to Equity Ratio

- Fixed Charge Coverage Ratio

Misc Other Ratios

- Cash Conversion Cycle

- Cash Ratio

- Compound Annual Growth Rate

- Contribution Margin

- Days Sales in Inventory

- Days Sales Outstanding

- Debt Service Coverage Ratio

- DuPont Analysis

- EBITDA

- Equity Multiplier

- Interest Coverage Ratio

- Internal Rate of Return

- Net Income

- Operating Margin Ratio

- Payables Turnover Ratio

- Price Earnings P/E Ratio

- Retention Rate

The above categories are explained separately, you can click on that to view details.

Purpose & Importance of Financial Ratio Analysis:

Ratios help in analyzing the performance trends over a long period of time.

- They also help a business to compare the financial results to those of competitors.

- Ratios assist the management in decision making.

- They also point out the problem and weak areas along with the strength areas.

- Ratios to help to develop relationships between different financial statement items.

- Ratios have the advantage of controlling for differences in size. For example, two businesses may be quite different in size but can be compared in terms of profitability, liquidity, etc., by the use of ratios.

Users of Financial Ratios:

Financial ratio analysis is aimed to measure the financial performance of a company and to define the financial position of a company through relevant indicators/ratio. There are many groups and individuals who want to know about their business performance.

I have explained below one by one who uses financial ratios;

- Bankers and Money Lenders: They Use profitability, liquidity, and investment ratio because they want to know the ability of the borrowing business in regularly scheduled interest payments and repayments of a principal loan amount.

- Investors: they Use profitability and investment ratio because they are more interested in profitability performance of business and safety & security of their investment and growth potential of their investment.

- Management: They use almost all ratios because management is interested in all aspects of organization i.e., both financial performance and financial condition of the business.

- Employees: They use profitability, liquidity, and activity ratio because employees will be worried about job security, bonus, and continuation of business and wage rate negotiating.

- Suppliers: They use liquidity ratio because suppliers are more interested in knowing the ability of the business to relax its short-term duties as and when they are due.

- Customers: They use liquidity ratio because customers will search for comfort that the business can stay alive in the short term and continue to supply.

- Government: They Use profitability ratio because the government may use profit as a basis for taxation, grants, and subsidies.

Ratio Analysis Example:

Financial Ratios Formulas:

The financial ratios are classified into different categories and sub-categories which link is available above, each ratio has its own formula you can get download short summary of the formulas used for calculating different ration in pdf by click here.

If you want to learn more about Financial Ratio Analysis you can visit