What is Solvency Ratios:

Solvency Ratios is used to measure the capability of a business to fulfill its long-term debts. Furthermore, solvency ratios identify going concern issues and a company’s ability to pay its bills in the long term. Solvency ratios is also known as leverage ratios,

Many people puzzled between solvency ratios with liquidity ratios. Though they both measure the ability of a company to repay its responsibilities to creditors, bondholders, and banks. Solvency ratios focus more on the long-term sustainability of a business instead of the current liability payments.

Better solvency ratios show a more creditability and financially sound company in the long-term.

You may also like to Read:

The frequently used solvency ratios include:

- Debt to Equity Ratio

- Equity Ratio

- Debt Ratio

-

Debt to Equity Ratio:

Debt to Equity Ratio is a Solvency ratio that compares a company’s total debt to total equity.

Lenders and creditors are closely watched Debt to Equity Ratio, as it can provide timely warning that the organization is so overcome by debt that it is unable to meet its payment obligations

The debt to equity ratio shows the percentage of company financing that comes from creditors and investors. Usually, the higher the ratio of debt to equity shows that more creditor financing such as bank loans are used than investor financing such as shareholders.

Formula of Debts to Equity Ratio:

Debt to equity ratio formula is simple. It is calculated by dividing total liabilities by total equity.

Take the illustration of TOYO Co It has $200,000 of bank Credit and a $600,000 mortgage on its property. The shareholders of the TOYO Co have invested $1,300,000. Example Debts to Equity Ratio

Now put the data into the formula.

Debts to Equity Ratio = Total Liabilities

Total Equity

Debts to Equity Ratio = 200000+600000

1300000

Debts to Equity Ratio = 0.6

A debt ratio of 0.6 shows that the liabilities of TOYO Co is half than its Equity.

Scrutiny/Analysis of Debts to Equity Ratio:

A lower debt to equity ratio generally indicates a more financially stable business.

Businesses with higher debt to equity ratio are considered riskier to creditors and investors than businesses with a lower ratio.

Debt to equity ratio of 1 would mean that investors and creditors have an equal stake in the business assets.

-

Equity Ratio:

The equity ratio also knows investment leverage. It is a solvency ratio that measures a number of assets that are financed by owners’ investments by comparing the total equity in the company to the total assets.

The equity ratio highlights two key financial concepts of a solvent business.

- If all of the liabilities are paid off, the investors will end up with the how many remaining assets.

- Element inversely shows how leveraged the company is with debt. The equity ratio measures how much of a firm’s assets were financed by investors.

Companies with higher equity ratios show new investors and creditors that investors believe in the company and are willing to finance it with their investments.

Formula of Equity Ratio:

Equity Ratio is calculated by dividing total equity by total assets. We can say, all of the assets and equity stated in the balance sheet are involved in the equity ratio calculation.

Example of Equity Ratio

We assume TOYO Co total assets are stated in the balance sheet is $250,000 and his total liabilities are $50,000. The total equity is $200,000. Here is TOYO Co equity ratio.

Equity Ratio = Total Equity

Total Assets

Equity Ratio = 200000

250000

Equity Ratio = 0.8

TOYO Co ratio is 0.8 this is a strong equity ratio. It means that investors instead of debt are currently funding more assets. 80% of the company’s assets are owned by shareholders and not creditors.

Scrutiny/Analysis Equity Ratio

Generally, higher equity ratios are usually favorable for companies. This is typically the case for numerous causes. Higher investment levels by shareholders indications potential shareholders that the business is worth investing. Thus many investors are ready to finance the business.

Equity financing is much inexpensive than debt financing because of the interest expenses related to debt financing. Companies with higher equity ratios should have less financing and debt service costs than companies with lower ratios.

-

Debt Ratio:

The debt ratio is a solvency ratio and can be defined as the ratio of total long and short-term debt to total assets. It can be understood as the proportion of a business’s assets that are financed by debt. We can also say, this shows how many assets the company must sell in order to repay all of its liabilities. It is stated as a decimal or percentage.

This ratio measures the financial leverage of a company. The higher levels of liabilities compared with assets are considered highly leveraged and riskier for lenders.

This helps investors and creditors to analyze the complete debt liability on the business along with the business’s capacity to repay the debt in future.

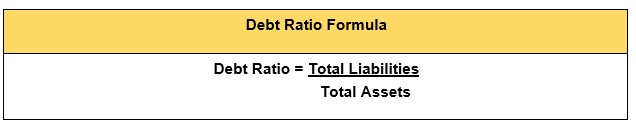

Formula of Debt Ratio:

Example of Debt Ratio:

TOYO Co applying for a new loan in the bank. The bank asks for TOYO Co balance Sheet to inspect his complete debt levels.

The banker notices that TOYO Co has total assets of $200,000 and total liabilities of $100,000. TOYO Co’s debt ratio would be calculated like this:

Debt Ratio = Total Liabilities

Total Assets

Debt Ratio = 100000

200000

Debt Ratio = 0.5

TOYO Co only has a debt ratio of 0.5. In other words, TOYO Co has 2 times as many assets as he has liabilities. This is a quite low ratio and indicates that TOYO Co will be able to repay his loan. TOYO Co should not have a problem getting accepted for his loan.

Scrutiny/ Analysis of the Debt Ratio:

A lower ratio is more favorable than a higher ratio.

A lower debt ratio typically indicates a more constant business with the potential of durability since a company with lower ratio also has lower complete debt. Each business has its own standards for debt, but .5 is sensible ratio & considered to be less risky.

Furthermore, company’s liabilities are only 50 % of its total assets. Basically, only its creditors own half of the company’s assets and the shareholders own the remainder of the assets.

The debt ratio of 1 means that total liabilities equals total assets. It means that if a company have to repay its total liabilities then it would have to sell off all of its assets. Once its assets are sold off, the business no longer can function.

If you want to learn more about Solvency Ratios you can visit