What is Perpetual Inventory System

Perpetual Inventory System or the periodic system may use by the company to maintain record for inventory. Under the periodic system, merchandise purchases are recorded in the purchases account, and the inventory account balance is updated only at the end of each accounting period. Perpetual inventory system have traditionally been associated with companies that sell small numbers of high‐priced items, but the development of modern scanning and computer technology has enabled almost any type of merchandiser to consider using this system.

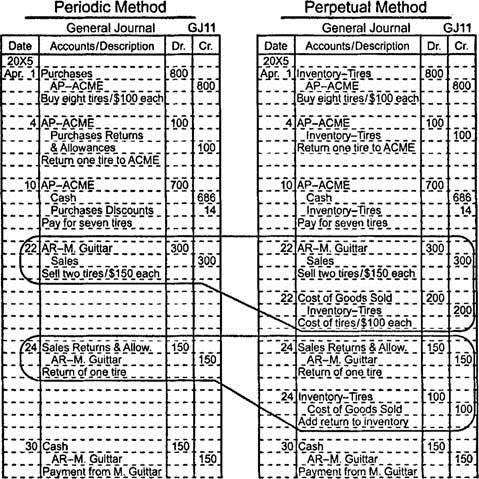

Under the perpetual inventory system, purchases, purchase returns and allowances, purchase discounts, sales, and sales returns are immediately recognized in the inventory account, so the inventory account balance should always remain accurate, assuming there is no theft, spoilage, or other losses. Consider several entries under both systems. The reference columns are removed from the illustration to simplify what you’re seeing.

Perpetual Inventory System Definition:

Perpetual inventory is a way of accounting for inventory that records the sale or purchase of inventory instantly through the use of computerized point-of-sale (POS) systems and enterprise asset management software.

You May also like to Read

Note: AP stands for accounts payable, and AR stands for accounts receivable.

Perpetual Inventory System Journal Entries Method.

As the two sets of circled entries indicate, two things happen when there is a sale or a sales return. First, the sales transaction’s effect on revenue must be recognized by making an entry to increase accounts receivable and the sales account. Second, the flow of merchandise between inventory (an asset) and cost of goods sold (an expense) is recorded in accordance with the matching principle. A sales return has the opposite effect on the same accounts.

Under the periodic system, the inventory and cost of goods sold accounts are updated only periodically, but under the perpetual inventory system, entries that recognize a transaction’s effect on these accounts occur when the revenue from the sale is recognized.

In a periodic inventory system, purchases are recorded throughout the year in the purchases account. The inventory count or value is not updated until the end of the year when a physical inventory count is performed.

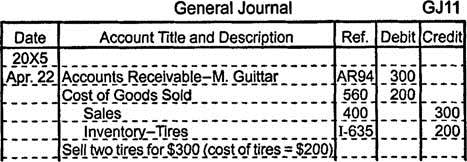

For convenience, a sale or sales return can be recorded under the perpetual inventory system with a compound entry that lists all four accounts.

the general journal provides a simple, consistent format to present new information. However, most companies would record the sale in a sales journal.

Perpetual Inventory System Advantages:

- It has system has numerous advantages over a periodic.

- It should updates the inventory in real time when purchases are made or inventory is sold.

- It prevents stock outs; a stock out means that a product is out of stock

- Gives business owners a more accurate understanding of customer preferences

- Gives valuable information to business owners, such as discounts, purchases, and returns

- Provides greater accuracy due to each inventory item being recorded on a separate ledger

- Allows business owners to centralize the inventory management system for multiple locations

- Reduces physical inventory counts in warehouses.

- Inventory subsidiary ledger is updated after each transaction.

Perpetual Inventory System Disadvantages

Implementation cost is high: the implementation cost of perpetual inventory system is high the business need to installed equipment and software preferred Enterprise Resource Planning (ERP). After installation of software’s its maintenance and upgrades is required.

Complexity: perpetual inventory system software is complex and not easy to understand that’s why a tanning session is required to be given to employees of the organization. That how to use these inventory software.

Timing Consuming:

A perpetual inventory system is more time consuming, in this system employee must record each transaction immediacy, while in periodic inventory system a transaction can be posted anytime in a day week or a month.

Perpetual Inventory System Example

(1). On 1st may 2015, Metro ZRK&Co purchases 15 washing machines at $400 per machine on account. The supplier allows a discount of 5% if payment is made within 10 days of purchase. The Hayat company uses net price method to record the purchase of inventory.

Perpetual Inventory System Journal Entries

The following journalize transactions in perpetual inventory system would be made in the books of Metro company to record the purchase of merchandise:

| Inventory | 5700* | |

| Accounts payable | 5700* |

*Net of discount: ($400 × 15) – ($400 × 15 × 0.05)

(2). On the same day, Hayat company pas $300 for freight and $120 for insurance.

The following journal entry would be made to record the payment of freight-in and insurance expenses:

| Inventory | 420 | |

| Cash | 420 |

(3). On May 07, Hayat company returns 5 washing machines to the supplier.

The return of washing machines to the supplier decreases the cost of inventory and accounts payable. The following entry would be made to record this decrease:

| Accounts payable | 1980 | |

| Inventory | 1980 |

(4). On May 9, Metro sends the payment via online banking system and takes the advantage of the discount offered by the supplier.

As the payment is made within 10 days, the Hayat company is entitled to receive discount. The following entry would be made to record the payment:

| Accounts payable | 3720* | |

| Cash | 3720* |

*($5700 – $1980)

(5). On May 15, Metro company sells 4 washing machines at 750 per machine. The Metro company does not allow any discount to customers.

The sale of 4 washing machines transfers the cost of inventory from inventory account to cost of goods sold account. Two journal entries would be made; one for the sale of 4 washing machines and one for the transfer of cost from inventory account to cost of goods sold account:

| Accounts receivables | 3,000 | |

| Sales | 3,000 | |

| Cost of goods sold | 2,068 | |

| Inventory | 2,068 |

To summarize the events of increase and decrease in the cost of inventory, Inventory T-account of Metro company is given below:

Inventory

| Date | Amount | Date | Amount |

| 1 May | 5700 | 7 May | 1980 |

| 1 May | 420 | 15 May | 2068 |

| Balance | 3102 |

Understanding Perpetual Inventory system is important for Accounting students and Accountant, it helps to maintain inventory under the standard method.

If you want to learn more about Perpetual Inventory System you can visit.