Bank Reconciliations Statement:

Bank Reconciliation Statement is prepared by every accountant in every organization where thousand of transaction take place.

Meaning of Bank Reconciliation Statement:

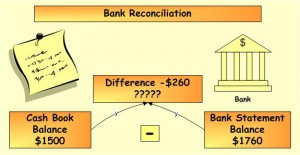

It is a statement prepared at the end of every month or so to explain the causes for differences between the balance of passbook and bank column of the cash book, as on a particular date and to reconcile between both the balances for the purpose of cross verification.

Objective of Bank Reconciliation Statement

The objective of the BRS is ;

- To determine the correct bank balance as per cashbook

- To tally the bank balance and cashbook balance

Importance of Bank Reconciliation Statement:

Preparation of bank reconciliation helps to point out errors in the accounting records of the organization.

- Cash is the most risky asset of an entity. Bank reconciliations provide the essential control mechanism to help protect the valued reserve through finding abnormalities such as unapproved bank withdrawals.

- If the bank balance shown in companies’ accounts confirmed correct by comparing it with bank balance it shows that bank transactions have been correctly recorded in companies’ accounts

- Monthly preparation of BRS helps in the regular checking of cash flows of a business.

Bank Balance:

In the last topic we discussed the procedure of cash book to record the cash transactions relating to bank.

Bank Reconciliation Statement Purposes :

Here i will explain the term bank reconciliation and state its reasons/ purpose for its preparation

1. In a large business concern all the receipts and payments are made through bank. All the cheques received are entered in cash receipt journal and all he cheques paid are entered in cash payment journal. From this journal a cash account is prepared in ledger. The balance of cash account shows the balance of cash at a bank at any time and in case of credit balance, he has overdrawn from the bank.

2. In a small business concern where the cash book is kept for receipts and payment of cash, a separate column is provided for payment of cash into bank. The balance of bank is ascertained by balancing this column of cash book. This is called as balance as per cash book. The debit balance of cash book means the trader has cash at bank and credit balance of cash book means he has overdrawn from the bank.

You may also read to understand well:

- How to prepare Bank Reconciliation Statement- A Practical Example

- Why we prepared Bank Reconciliation Statement.

Bank Statement:

1.Passbook:

- This is the copy of the depositor’s account in the bank ledger. All the cheques drawn and paid into the bank are recorded in this book. When the cash or cheque is paid into the bank it is credited in the pass book when any cheque I issued it is debited in the pass book the balance of depositor’s account is indicated ass credit when in favour of the customer and if the customer has overdrawn from the bank it is shown as debit balance.

- Bank Statement: The Bank usually sends a periodical return to its depositors, called as bank statement .this statement begins with the balance at the beginning of the period. The cheque/cash deposited by the customer are added, while cheques drawn by him are deducted. The bank charges interest on overdraft for the period is also deducted. The remaining balance if in favour of the depositor is recorded as cash at bank and if in favour of a bank is recorded as bank overdraft.

why bank reconciliation statement is prepared:

The Customer usually prepares a statement to verify and check that bank record and find the cause of disagreement of the balance as shown by the bank statement /passbook and that shown by his own record. The purpose of preparing this statement is;

- To know the correct balance of cash at bank for recording in Trial balance and balance sheet.

- Necessary adjustments in bank balance be made prior to the end of term.

- To know the error if any in the record and to correct the in time.

- To complete the record in cash book.

- To know the entries regarding collection of cheues/drafts paid into bank.

- To check the entries regarding the payment of cheques issued.

The statement prepared for the adjustment of cash balance after comparing the entries of pass book and cash book is known as bank reconciliation statement (BRS).

The practical example will show that how we prepare bank reconciliation statement.

If you want to learn more about BRS kindly visit